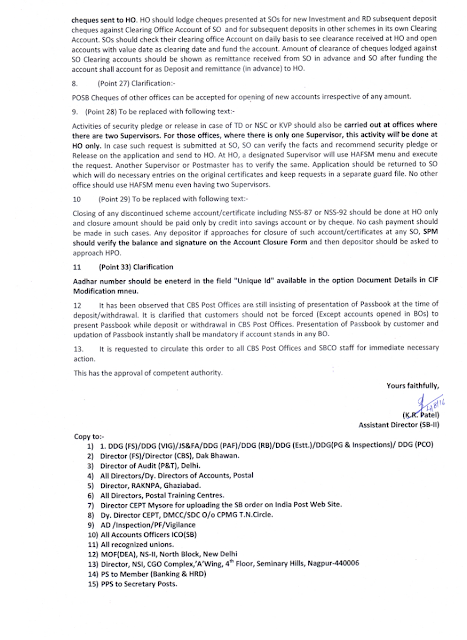

No 25-11/2016-FS-CBS Government of India

Ministry of Communication & IT

Department of Posts

Financial Services Division

Dak Bhawan,New Delhi-110001

Dated: 04.08.2016

To

All Heads of Circles/Regions

AddI. Director General,APS,New Delhi.

ADDENDUM

Subject:Steps to be taken for smooth functioning of POSB operations and prevention of frauds in CBS Offices.

Respected Sir/Madam,

The undersigned is directed to refer to this office letter of even number dated 21.6.2016 on the subject vide which various steps to be taken by Post Offices/Divisions/ Circles were circulated to Heads of Circles. On receipt of references from various circles, the competent authority has decided to issue following further clarifications/amendments to the above said order Now:-

1. (Point 6) To be replaced with following test:-

Each and every counter PA should make all the cash received from Treasurer and cash returned to Treasurer entries in Finacle between VAULT and His/her Tellet Cash Account. Supervisors should ensure that all such entries are tallied with Vault/Teller Cash Account and entries shown in SB Cash. In addition to this each and every counter PA should make its Teller Cash Account ZERO before start of End of Day. If above functions are not done,suitable disciplinary action should be taken against the official concerned.

2. (Point 9) To be replaced with following text:-

Freezing and Unfreezing of any account/Certificate should be done in the Post Offices where there are two Supervisors in Finacle. In case of Post offices with only one Supervisor,request with prescribed documents should be sent to HPO.

3. (Point 12) To be replaced with following text:-

Revival of silent account shall be done at post offices having two Supervisors in Finacle for which a register in manusript shall be maintained at each office. Application for revival, KYC documents and KYC Form s-h.all be filed

in a separate Guard File at each office. For Post Offices with single Supervisor, this should be done by HO. SOs with single Supervisor have to enter application for revival in the register to be maintained and send application for revival duly recommended with prescribed KYC Form (in duplicate) with KYC documents to HO on the day of receipt. HO will verify the signatures with the system and ensure proper KYC documents have been taken. HO will first unfreeze the account and then modify the status from Dormant to Active. HO will return the application to SO alongwith one KYC Form and KYC documents duly signed mentioning date of revival and one copy of KYC Form will be sent to CPC. SO shall maintain a separate guard file to keep these applications and KYC documents as well as KYC Form which will be checked by visiting/inspecting authorities.

4. (Point 11) Clarification:-

Transfer of Savings Account from SBGEN to SBCHQ can be done at SO Level. Every SO should maintain a register to enter all such requests and file request applications in separate guard file.

5. (Point 16) Clarification:-

SBCO staff should place full signature on the vouchers prescribed to be checked with system generated LOT in token of having checked TRAN 10, Account Number and Amount in addition to general check of vouchers as prescribed..

6 (Point No.19) This may be treated as deleted.

7. (Point 24) To be replaced with following text:-

SOs should not lodge cheques in Finacle. Cheques received for New Investment and subsequent deposit should be sent to HO by preparing manual list. For this purpose, SO should maintain a register for entering all the cheques sent to HO. HO should lodge cheques presented at 50s for new Investment and RD subsequent deposit cheques against Clearing Office Account of SO and for subsequent deposits in other schemes in its own Clearing Account. 50s should check their clearing office Account on daily basis to see clearance received at HO and open accounts with value date as clearing date and fund the account. Amount of clearance of cheques lodged against SO Clearing accounts should be shown as remittance received from SO in advance and SO after funding the account shall account for as Deposit and remittance (in advance) to HO.

8. (Point 27) Clarification:-

POSB Cheques of other offices can be accepted for opening of new accounts irrespective of any amount.

9. (Point 28) To be replaced with following text:-

Activities of security pledge or release in case of TO or NSC or KVP should also be carried out at offices where there are two Supervisors. For those offices, where there is only one Supervisor, this activity will be done at HO only. In case such request is submitted at SO, SO can verify the facts and recommend security pledge or Release on the application and send to HO. At HO, a designated Supervisor will use HAFSM menu and execute the request. Another Supervisor or Postmaster has to verify the same. Application should be returned to SO which will do necessary entries on the original certificates and keep requests in a separate guard file. No other office should use HAFSM menu even having two Supervisors.

10 (Point 29) To be replaced with following text:-

Closing of any discontinued scheme account/certificate including NSS-87 or NSS-92 should be done at HO only and closure amount should be paid only by credit into savings account or by cheque. No cash payment should be made in such cases. Any depositor if approaches for closure of such account/certificates at any SO, SPM should verify the balance and signature on the Account Closure Form and then depositor should be asked to approach HPO.

11 (Point 33) Clarifications

Aadhaar number should be enetered in the field “Unique ld” available in the option Document Details in CIF Modification menu.

12 It has been observed that CBS Post Offices are still insisting of presentation of Passbook at the time of deposit/withdrawal. It is clarified that customers should not be forced (Except accounts opened in 80s) to present Passbook while deposit or withdrawal in CBS Post Offices. Presentation of Passbook by customer and updation of Passbook instantly shall be mandatory if account stands in any BO.

13. It is requested to circulate this order to all CBS Post Offices and SBCO staff for immediate necessary action.

This has the approval of competent authority.

Be First to Comment