The steep cuts in bank home loan lending rates from a slew of banks have come as good news for new borrowers. State Bank of India (SBI)’s effective home loan rates will now be at 8.6 percent compared with 9.1 percent earlier. This is adding the 60 basis points spread above the new MCLR (marginal cost of lending rates) of 8 percent.

Other banks like Punjab National Bank, Union Bank of India too, have brought down their benchmark lending rates by up to 0.9 percent. This is good news for new borrowers since big reduction in home loan interest rates means their loan tenure would come down by a few years for those who opt for 20-25 year home loan, but existing borrowers may not benefit since banks have retained their base rate where it is based on which the old contracts are agreed upon. That is so unless these customers pay a fee and shift their loans to the MCLR-based loan structure.

Home loan. Representational Image Home loan. Representational Image Why have banks cuts home loan rates in such quantum? One reason is that there has been huge inflow of deposits post the demonetisation of old Rs 500, Rs 1,000 notes as customers rushed to banks to deposit their invalidated currencies. The other is Prime Minister Narendra Modi’s ‘appeal’ to banks to push credit to low-income segments and cut rates. This gentle request from the owner (government controls public sector banks) would logically have put pressure on banks to follow suit. This was also a political necessity for the government to ease the negativity among the public post the note ban.

The huge inflow of deposits is a boon and burden to banks at the same time. A boon because they have sudden spike in low-cost deposits but a burden if they are not able to deploy it profitably which will then result in a carry cost to the lenders. As of now, the credit growth is abysmal and most of the money is parked in government securities and Market Stabilization Scheme (MSS) bonds, where banks get a lower yield now. Currently, the yield on one year G-sec rate is at 6.408 percent. If the current round of rate cut translates into a spike in credit growth, then banks will make money. But only if there is no sudden outflow of deposits once the demonetisation exercise is over and people will think of ways to deploy their funds. On the other hand, if banks fail to generate a commensurate increase in home loan growth despite the interest rate bonanza, then there will be more bad news for savers in the form of more deposit rate cuts.

“Today, the huge surge of deposits is being deployed in very low yielding assets (gsecs & mss bonds). Credit growth is very tepid. Any increase in credit will help yield pickup and thereby spreads. If still no credit growth, then NIM (net interest margin) will be under stress. If that happens, or deposits flow out, then we will look at lowering deposit rates,” said SBI chairman Arundhati Bhattacharya.

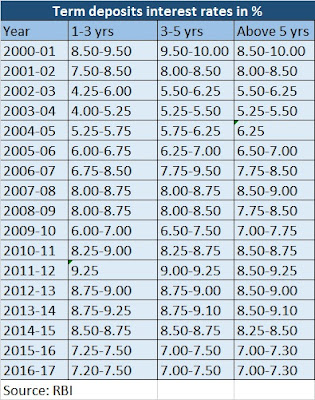

This is sort of a warning to savers, who are already hit because of a steep fall in deposit rates over the last one year since the Reserve Bank of India (RBI) began cutting rates. Banks have been smart to cut their deposit rates much faster than their lending rates to protect their margins. The one-year deposit rates have fallen from around 9 percent to 6.9 percent for most banks, whereas the fall in lending rates have been painfully slow. If the current steep rate cuts in home loan rates — which is mainly nudged by PM Modi’s ‘appeal’ — do not translate to increase in credit growth and higher yields, banks will find a way to make money by cutting their deposit rates more. This will hit hard the majority small depositors who have parked their money in banks.

Will credit growth revive now? One needs to wait and watch because the fall in demand is not only due to high lending rates but also several others factors. These include overall slowdown in economies activities, lack of adequate growth employment, and unrealistic, speculative real estate prices. The point here is just because the interest rate has come down, one doesn’t rush to a bank for a home loan.

According to Centre for monitoring Indian economy, the unemployment trend has actually picked up post-demonetization and several lakhs of jobs have been reportedly lost in informal sector. This reason along with lackluster economic activities, it is doubtful whether lower interest rates alone will spur loan demand. Deposit rate cuts will be a double whammy to the saver since returns on other national savings schemes too is on a downward trend. The fact is that banks did not have an option but to go for sharp lending rates to deploy their funds. One needs to hope this step revives the credit demand in the home loan segment. If not, savers are in for a rude shock in the form of deeper deposit rate cuts.

source:www.firstpost.com

Be First to Comment